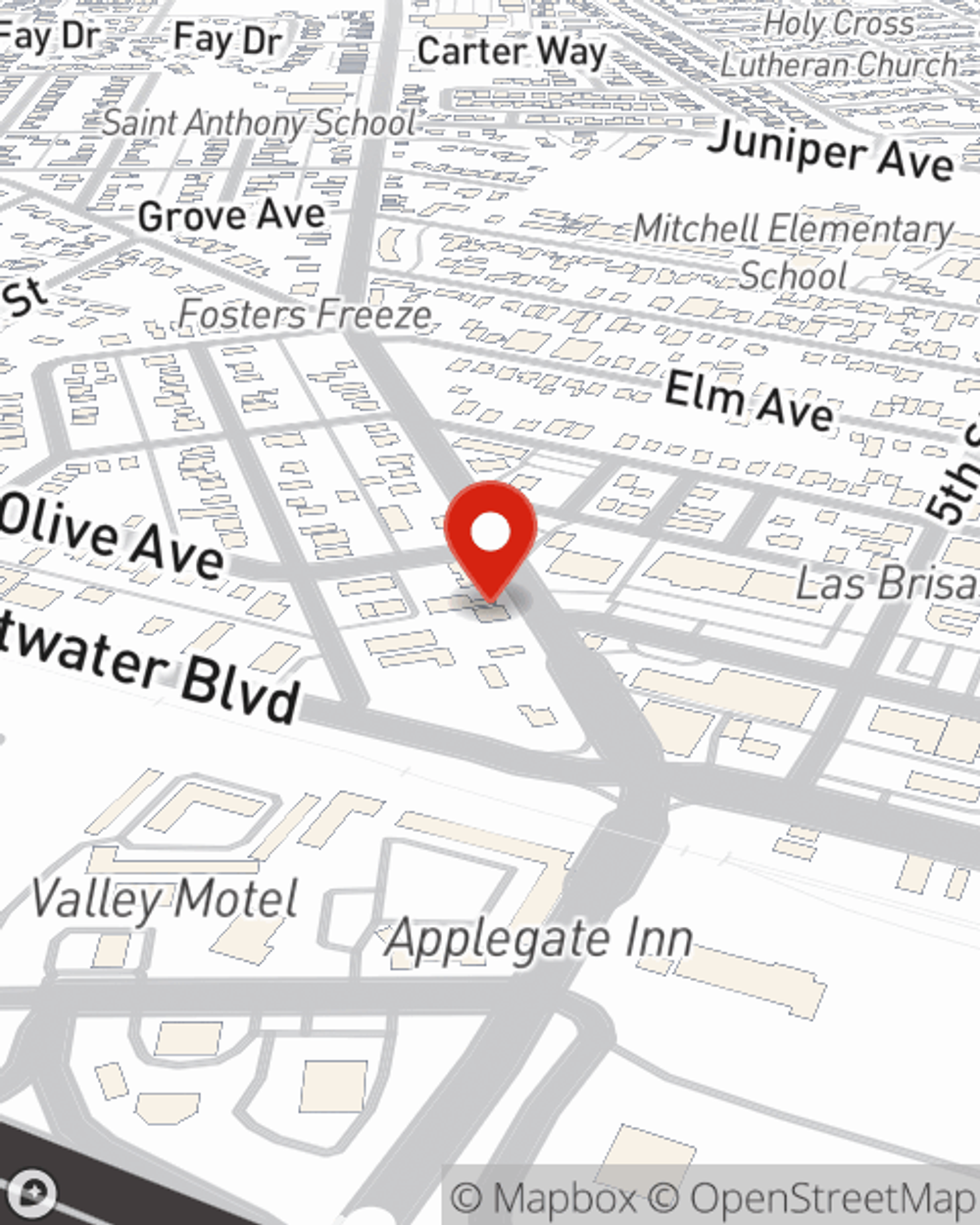

Renters Insurance in and around Atwater

Your renters insurance search is over, Atwater

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- California

- Oregon

- Arizona

- Atwater

- Merced

- Tempe

- Livingston

- Williams

- Tigard

- Winton

- Turlock

- Modesto

- Chowchilla

- Fresno

There’s No Place Like Home

Home is home even if you are leasing it. And whether it's a townhome or a condo, protection for your personal belongings is a good idea, especially if you own items that would be difficult to fix or replace.

Your renters insurance search is over, Atwater

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

Renters frequently underestimate the cost of replacing their belongings. Just because you are renting a townhome or home, you still own plenty of property and personal items—such as a tablet, desk, couch, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why buy your renters insurance from Terry Solano? You need an agent with the knowledge needed to help you evaluate your risks and examine your needs. With personal attention and skill, Terry Solano is waiting to help you keep your things safe.

Don’t let fears about protecting your personal belongings make you uneasy! Contact State Farm Agent Terry Solano today, and see how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Terry at (209) 358-6877 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Terry Solano

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.